June 10, 2023

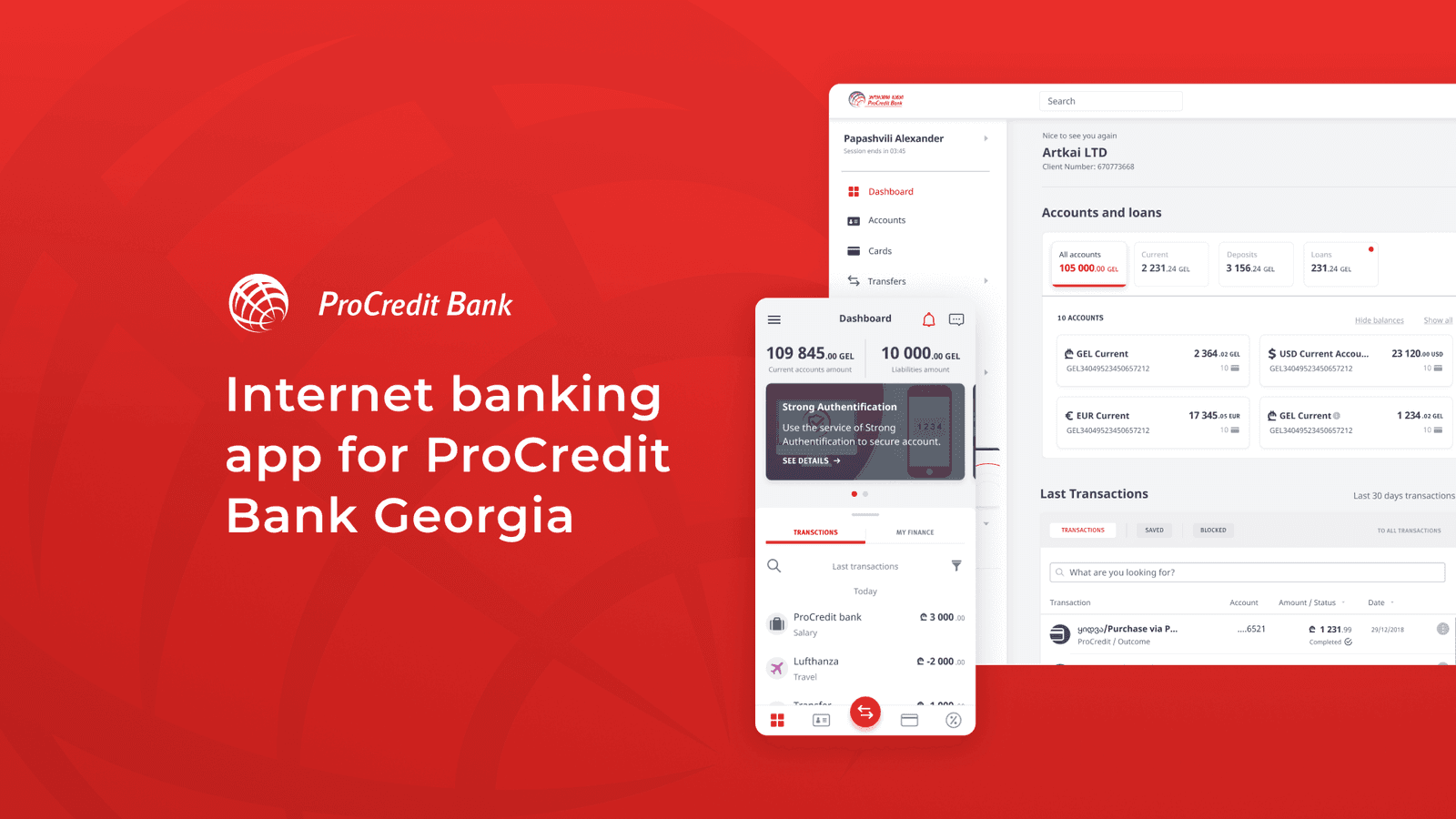

Upgraded internet banking experience for ProCredit bank Georgia by Artkai

ProCredit Bank is a development-oriented commercial bank, offering excellent customer service to small and medium enterprises and to private individuals who have the capacity to save and who prefer to do their banking through electronic channels. Artkai has been working with ProCredit Group for more than five years now, providing digital product design and development services to its branches across the world.

This time we worked with ProCredit Georgia to help them fully redesign and rebuild their online banking interface that will be used in 13 countries across all online platforms.

Table of contents:

Background

ProCredit Group is an international group of full-service commercial banks operating in South-Eastern and Eastern Europe, South America, and Germany. ProCredit banks always focused on private individuals and small and medium-sized enterprises, providing its clients with all the essential services from lending and deposits to cash settlement services and acquisition.

In May 2019, Arktai was approached by ProCredit Bank Georgia to support them with the bank’s online platforms. While having a reputation as one of the most innovative banks in Georgia, online services (the mobile application specifically) should be in accordance with this image.

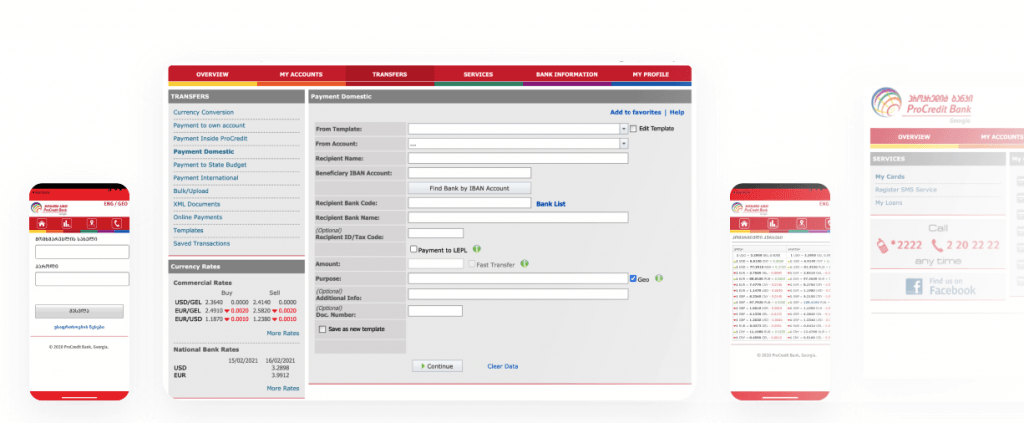

ProCredit Bank’s existing internet banking did not fully meet clients’ needs, which resulted in the following problems:

- The overwhelming workload of the contact center. Out of all contact center calls, 50% were regarding difficulties clients experienced with the bank’s mobile application. Instead of attracting new clients and providing financial consulting, personal assistants spent half of their time navigating clients through the interface.

- Negative customer reviews. In the reviews clients left about the mobile service, most were comparing it with Windows 98 and complaining it only takes up their phone space.

- Wasted resources. Instead of one sufficient application that would cover all the internet banking functionality, there were three different semi-functioning apps. Besides confusing the clients, it was also causing the bank to lose money and person-hours on the maintenance.

The product’s philosophy has always reflected four core values: transparency, simple and flexible products, individual approach, and in-depth understanding of clients’ needs. For a long time, this philosophy was the reason behind ProCredit customers’ long-term loyalty and satisfaction. But in the digital era, online solutions in banking became one more important part of maintaining a long-term partnership.

Our goals

Artkai’s high-end purpose was to reinforce customers’ loyalty and the bank’s competitive position in the Georgian market as innovators. Here is what it meant in practice:

- Digitize all the processes. Providing users with remote access to all banking services would reduce the workload on branch workers, advance cashless operations, contact center staff, and business advisors, focusing resources on financial consulting and attracting new clients.

- Improve user experience. To extend the innovative reputation of ProCredit bank on the online experience, we had to:

- create one self-sufficient mobile application and integrate it with all the existing Internet banking functionality;

- create a user-friendly interface that communicates ProCredit’s values, makes all the features easy to use and delivers a consistent user experience across all its online services.

Target audience

Private individuals. The bank’s approach to private clients is quite selective. It mainly works with medium or high-income households who conduct daily payments and transfers and prioritize savings and budget planning.

Business entities. These are mainly small or medium businesses that want to get a full range of credit and non-credit services: make low-interest loans to grow their business, receive payments, conduct transactions, and so on.

ROLES & RESPONSIBILITIES OF ARTKAI TEAM

- UX/UI designers – created UI prototype for Mobile banking app with all the features;

- Project manager – managed the teamwork between the design and development process, coordinated communication with the client;

- Front-end developers – developed the front side of the app and adapted it to IOS and Android operating systems;

- QA – examined the end-products for the mobile application bugs and compliance with the Internet banking features.

How we solved the problem

Step 1: Discovering the field

Having accomplished numerous successful projects in fintech and banking, we can say with certainty: that in-depth research was the key to every one of them. To find the pain points and, ultimately, break down goals into steps, we conducted two-week research discovering business and user needs.

Our discovery stage consisted of:

- Two-day onsite workshop with ProCredit employees. During this workshop, we interviewed ProCredit workers to gain their perspectives, needs, wants, and expectations from the product.

- 21 interviews with bank clients. By asking the right questions, we found out the target audience’s workflow, priorities, decision-making process, and pain points we could solve.

- 9 usability tests. A usability test is a perfect way to observe the user behavior when they use the product. It helped us identify problem arias in the current interface and an idea of what precisely needed to be changed to improve the user experience.

What we discovered:

- 30% of clients simply weren’t aware of the key features of the bank's online services and kept processing their operations in offline branches;

- 70% prefer to use templates for making payments and other repeating tasks, but they didn’t understand how to use them in that interface.

- 65% of the business clients take loans for their operations, but because of the poor UX/UI design, they didn’t know that they could be doing this online.

- 99% use internet banking daily for core operations like transaction verifications, transfers, etc.

We also discovered the users’ standard workflow and established habits and patterns in using the apps. These specificities of their habits became the foundation for the new product that let us create an interface that, while being better, would still be familiar to them.

Step 2. Analyzing the insight and coming up with a concept

All these insights helped us develop project goals and concepts and, together with the ProCredit team, create an optimal process and backlog.

According to the gathered information, the upcoming design had to be:

- Flexible and personalized. Users have a set of habits and preferences. The design we were creating had to provide users with enough freedom to personalize the interface according to their needs.

- Clear and informative. After seeing how many people didn’t know how to use the applications, we had to make sure they will have full support and information on each step but without feeling overwhelmed.

- Providing control. Users wanted to have more control over their finances, so we had to figure out how we can give them that.

- Secure. ProCredit bank takes its security very seriously, so the new experience we were creating had to support the latest security innovations.

- Consistent. Most clients use both web and mobile versions, so our task was to make this experience consistent. They must be able to switch between versions without feeling disoriented and get the full functionality from each application.

- Informative. The system must notify users about their transactions, payment overdue, and other changes. Also, users must be aware of all the new features and services the bank implements.

What we came up with

To implement our new design solutions, we first had to create an integrated ecosystem for mobile and web services. In ProCredit’s case, Artkai created a new GUI (Graphical User Interface) system using React and React Native as a Front-end tech stack, which we agreed was the best choice.

NEW BANKING FUNCTIONALITIES

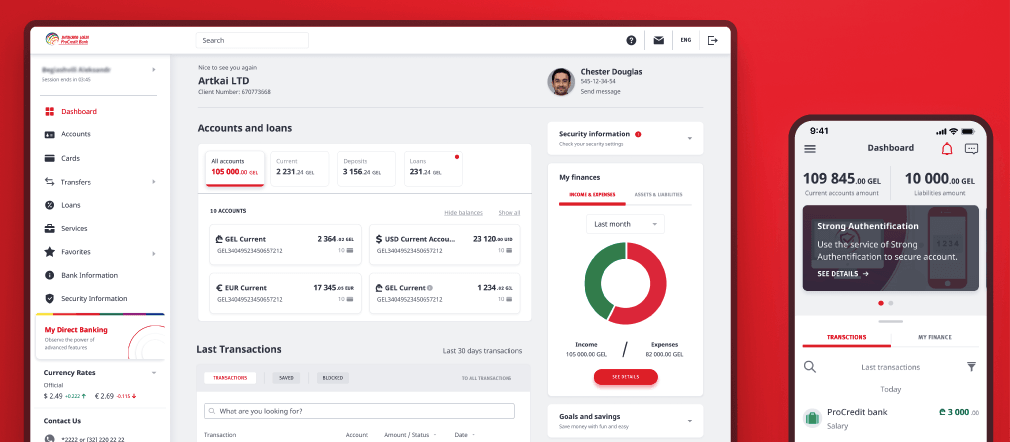

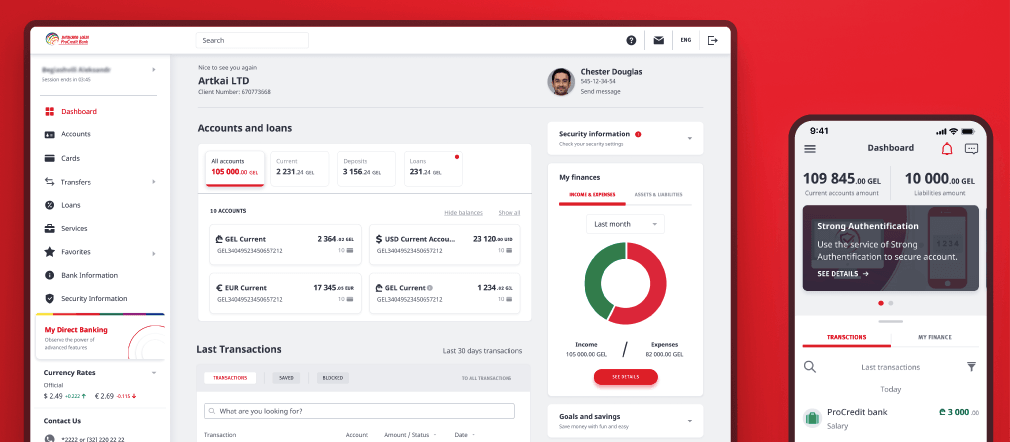

Dashboard. We came up with a new dashboard containing all the main features and topics the clients use regularly. We also added personalized navigation to remove all the possible friction and make the experience more individualized. It provided users with an overview of and full access to the wide range of features and functionality. It makes their experience consistent and clear regardless of the platform they are using.

Old design

My finances. “My finances” is an entirely new feature Artkai production team designed and built from scratch to give ProCredit clients the desired control over their finances. Now they can track their expense and income transactions and view statistical data in different graphic forms on both mobile and web applications.

UX DESIGN SOLUTIONS: WEB INTERNET BANKING

Fast access navigation. We developed quick access navigation based on previous user habits to help them effortlessly find key banking elements. We also enabled clients to customize their menu by adding the most often used elements in the Favorite section.

Contextual information. Many users said they weren’t aware of bank news and new features. To solve this problem, we provided them with contextual information, locating these elements on the right side of the screen. There they could see a card with all the new available functions and bank updates. On the left, we placed currency rates.

Friendly prompts. To make multi-step operations clear and easy to complete, we created a system that speaks to the user with prompts. We explained all the steps in a modern and friendly tone, reducing the need to seek help at the call center.

UX DESIGN SOLUTIONS: MOBILE BANKING

Contactless account registration. To enable users to create new bank accounts without visiting the branch, we integrated new registration processes for existing and new clients. Existing clients now can swiftly open new accounts directly via internet banking, while new clients can open an account using Video Identification tools.

Smart login. Previously, the user was represented by “Username” and “Password,” making the login process tedious. We made this process easier yet still secure by adding four-digit passcode or Touch/Face ID options. The option the user gets will depend on the operating system and the smartphone’s capabilities.

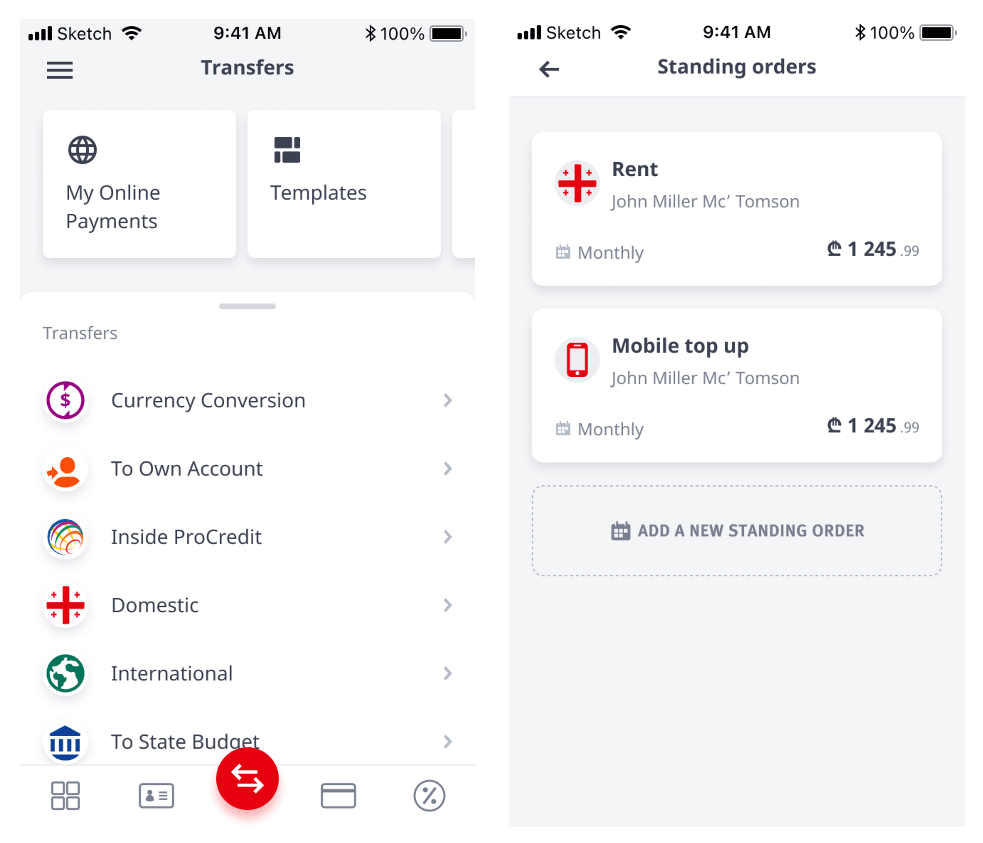

Fast transfers & payments. To speed up transfers and payments, we separated repeated (automatic) transactions from the new ones that require manual completion. Now, prefilled transfers appear as cards with a horizontal scroll on top of the screen, while new transactions can be handled separately.

What we achieved

Let’s look at the outcomes in numbers after the release:

- 99% of available banking services are digitized and can now be performed fully online;

- x1,5 faster to make a transfer via web or mobile banking;

- x2 faster login compared to the previous version;

- +60% faster to block a card via mobile application;

- Significant increase of positive feedback about the bank services.

We are incredibly grateful for the pleasant feedback from the ProCredit team. We can’t help but share with you.

https://youtu.be/QWY57v9B_dw

Conclusion

Artkai team is proud of its collaboration with ProCredit Bank Georgia. We created a modern design based on the ProCredit Group guidelines with the new functionality, that bank customers will enjoy. The results of all the work Artkai has done speak for themselves. To tell us about your product, reach out to our team, and let's make your idea happen!

See the result of our first cooperation with ProCredit Group here.

Clients and Results

Schedule your free consultation

Don't miss this opportunity to explore the best path for your product. We are ready to delve into the specifics of your project, providing you with expert insights and optimal solutions.

Book your free sessionRead More

Explore articles from Artkai - we have lots of stories to tell

Join us to do the best work of your life

Together we advance the human experience through design.